Get a Money Network

Card today!

Money Network helps you simplify your finances with one all-purpose prepaid Debit Mastercard for receiving, spending and managing your money in real time, all the time!

Money Network gives you the

savings, convenience and security you deserve

More Savings

-

No activation fee2 or credit check to get started

-

Access your money at thousands of surcharge-free, in-network ATMs3

-

No overdraft fees2

-

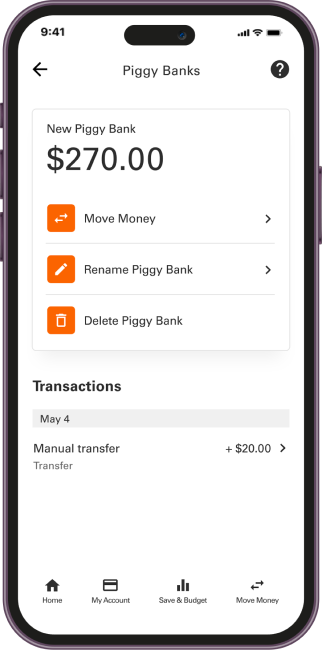

Free mobile App1 for money management

More Benefits

-

Get paid faster4 with Direct Deposit

-

Make purchases anywhere Debit Mastercard is accepted

-

Tools to set aside money for a rainy day

-

Set up other Direct Deposits – tax refund, government benefits, job wages and more

More Security

-

Eligible for protection from unauthorized purchases with Mastercard Zero Liability5

-

EMV chip cards for added protection

-

Advanced threat detection and cybersecurity systems

More than an Account

-

Track and manage your funds from anywhere

-

Manage your funds, set aside money, pay bills6 and more with the mobile App1

-

Shop anywhere Debit Mastercard is accepted: in-store, online or by phone

-

No overdraft fees:2 spend only your available balance

-

Get cash back at the register with PIN-debit purchases at participating merchants

-

Get toll-free access to customer support 24/7